Business Insurance in and around Bethesda

One of the top small business insurance companies in Bethesda, and beyond.

Cover all the bases for your small business

Help Prepare Your Business For The Unexpected.

When experiencing the challenges of small business ownership, let State Farm take one thing off your plate and help provide quality insurance for your business. Your policy can include options such as worker's compensation for your employees, extra liability coverage, and business continuity plans.

One of the top small business insurance companies in Bethesda, and beyond.

Cover all the bases for your small business

Get Down To Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a juice store, a pet groomer, or a dance school, having the right coverage for you is important. As a business owner, as well, State Farm agent C Kim understands and is happy to offer personalized insurance options to fit your business.

Call C Kim today, and let's get down to business.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

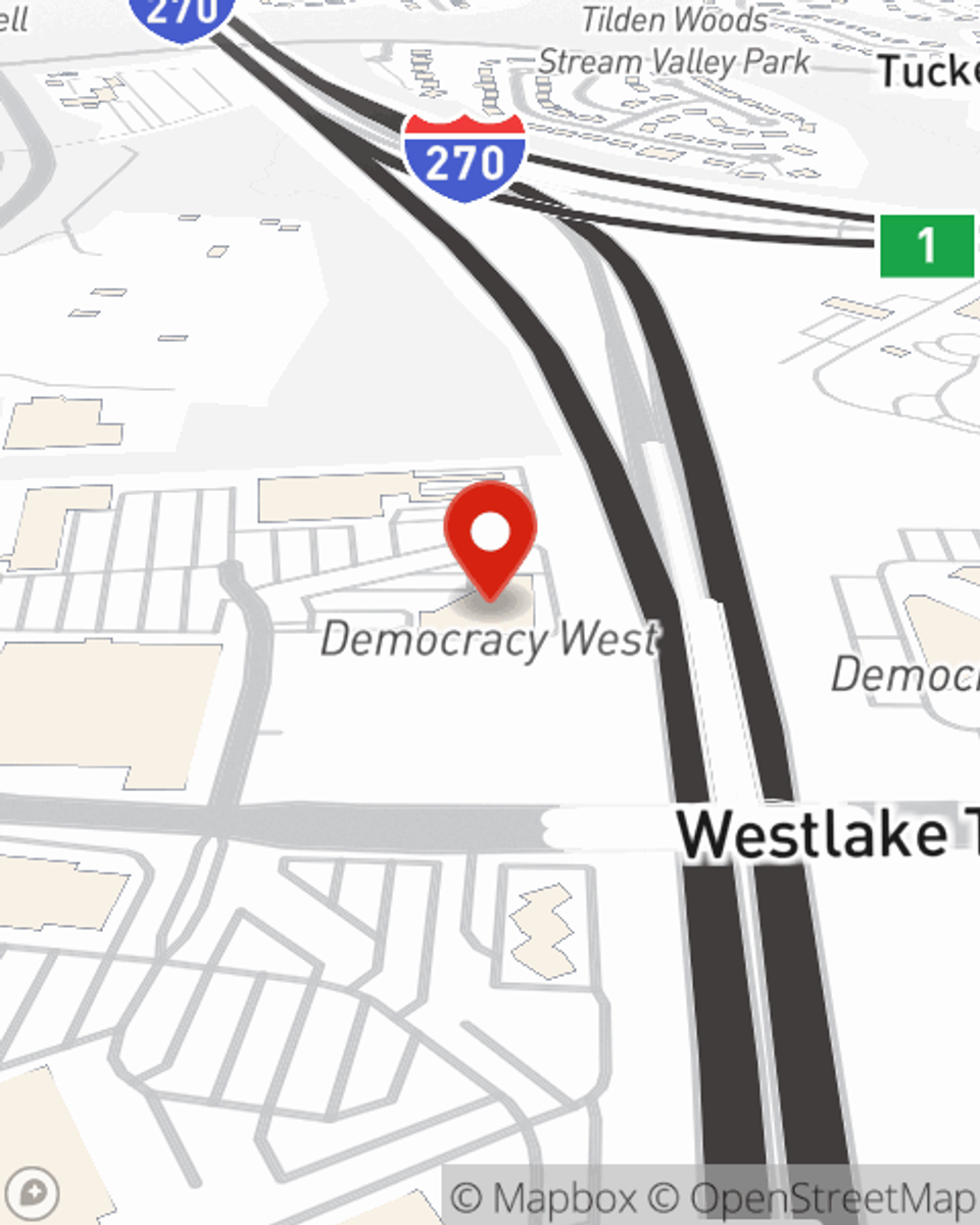

C Kim

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.